According to the May real estate review published on Wednesday by the Chief Economist at the Ministry of Finance, just 1,700 new apartments were sold on the open market over the course of the month, a drop the Ministry attributes to new restrictions on developer financing offers. May also saw a sharp decline in the sale of secondhand apartments with safe rooms in Tel Aviv and Bat Yam.

By Dror Neer Kastel, Nadlan Center

A real estate review for May, published Wednesday by the Chief Economist at the Ministry of Finance, shows that Israel has seen a drop of more than one-third in new home sales over the past year. The data points to May 2025 as one of the weakest months for the housing market in over two decades. A total of 6,698 transactions were recorded, including government-subsidized apartments. This represents a 16% decline compared to May last year. While there was a 7% increase from the previous month, that uptick is likely due to the reduced number of workdays in April because of Passover.

Contractor sales in May totaled 2,374 units, including government-subsidized apartments. Compared to May last year, this is a 36% drop, continuing a decline in transaction volume since the start of 2025, with a sharper downturn in the past two months. Compared to April, which included the Passover holiday, this is a rise of less than 1%. Excluding subsidized sales, contractors sold only 1,720 units on the open market—a sharp 44% decrease from May last year, marking one of the lowest May figures since the early 2000s. Compared to April, however, this is an 11% increase.

The Ministry of Finance explained that the decline in contractor sales on the open market in April–May was likely due largely to the Bank of Israel’s new restrictions on financing benefits offered by developers.

Secondhand home sales in May totaled 4,324 units. Here, there was a slight 1% increase compared to May last year and an 11% rise compared to the previous month. However, this is still a low transaction volume compared to past Mays since the early 2000s.

Ramat Gan Leads in Financing Benefits at 70% of Deals, Netanya Sees Sharp Decline

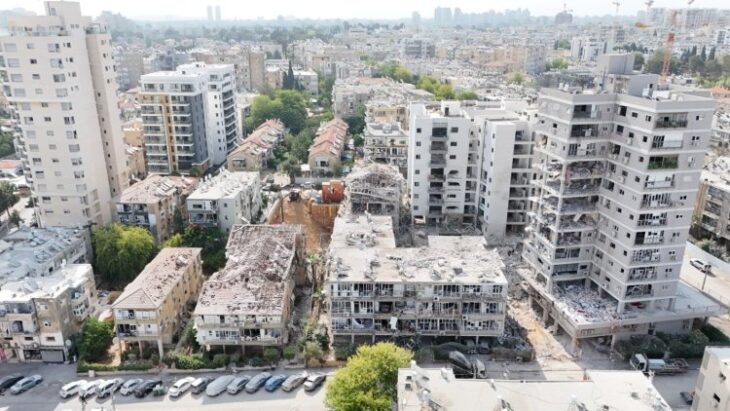

The sharp year-over-year drop in contractor sales in May spanned almost all regions, except for the Tiberias area, which saw a 68% increase—but this amounted to just 57 units. In all other regions, declines ranged from 19% in the Hadera area to 60% in the Tel Aviv area. The Tel Aviv area, which includes only Tel Aviv and Bat Yam, showed the steepest year-over-year decline in April–May contractor sales. In May last year, 60% of open-market transactions in this area were for new apartments, compared to about 40% this May.

An analysis of reported financing benefits offered by developers shows a continued decline in three out of five regions in May, following the Bank of Israel’s new restrictions introduced in April. The Netanya area—which includes the Sharon cities—saw the most dramatic shift: while about two-thirds of contractor sales included financing benefits in March, that figure dropped to just one-fifth in May. Hadera also experienced a sharp decline, while Be’er Sheva saw a more moderate decrease.

In contrast, the central region saw a rise in the relative frequency of financing benefits in May, continuing an upward trend from the previous month. Ramat Gan stood out in particular, with 70% of contractor sales in May involving financing benefits, compared to just 27% in March.

The share of new apartments bought “off-plan” continued to decline in May for the second consecutive month. In May, this stood at 60%, down 4% from the previous month and 7% below the level in March. Compared to May last year, it dropped by 2.7%.

Just Before the Iran War: Slump in Sales of Secondhand Homes with Safe Rooms in Tel Aviv and Bat Yam

An analysis of secondhand apartment sales nationwide shows that the share of transactions involving a safe room (mamad) rose significantly in October 2024, following Iran’s second missile attack. In contrast to the sharp decline that followed the first Iranian strike and preceded the outbreak of the war with Hezbollah in September 2024, the drop in November–December was relatively mild. Starting in January 2025, the percentage of mamad-equipped apartments in secondhand sales began climbing again, reaching a peak of 60% in April–May, likely influenced by growing media speculation about a possible confrontation with Iran.

In contrast to national trends, the Tel Aviv area (which includes only Tel Aviv and Bat Yam) stands out as the only region where the percentage of secondhand apartments with a safe room has declined since the start of 2025. In May 2025, it stood at 28%—the lowest level since at least January 2024, and only 4% more than the average rate of mamad-equipped units in the general housing stock of these two cities.

Investor purchases in May totaled just 923 units, a 31% drop compared to May 2024. This followed a 27% decline in April and more moderate declines during the first three months of the year. Compared to April, this is an 8% increase. As a share of total transactions, investors accounted for 14%, three percentage points lower than May of last year and unchanged from the previous month. Investor sales in May totaled 1,232 units, a 10% drop from May last year and over 1% lower than the previous month.

First-time homebuyer purchases in May totaled 3,679 units, including government-subsidized deals—an 18% drop from May last year. This continues the downward trend in this segment since the beginning of the year, following nearly continuous growth throughout 2024. Compared to April (a month with fewer workdays), there was a 4% rise. Excluding government-subsidized deals, open-market first-time homebuyer purchases totaled 3,025 units, a sharper 21% drop year-over-year. This mirrors April’s decline and follows more moderate decreases in the first three months of 2025.

Upgraders purchased 2,096 homes in May—a 3% drop from May last year, the smallest decline among all buyer segments, and a 13% increase compared to the previous month. The share of “downsizers” stood at 28%, 3% more than the previous month and 4% more than in May last year.

Nadlan Center is Israel’s leading real estate news and knowledge platform in Hebrew, created for industry professionals. Founded by experts in the field, it delivers in-depth, up-to-date coverage on urban renewal, planning and construction, taxation, and housing policy — tailored to the needs of developers, investors, planners, and financiers. In addition to its widely read news content, Nadlan Center hosts major industry events, professional conferences, and training programs that support the growth and development of the Israeli real estate sector.

Learn more: https://www.nadlancenter.co.il