Dun & Bradstreet’s Q1 2025 report offers a glimmer of cautious optimism for homebuyers. While challenges in the housing market persist, early indicators point to a potential shift in direction. Land prices in government tenders are on the decline, and growing competition among developers, coupled with new regulatory restrictions, may soon curb rising prices and even trigger a drop in home prices in Israel in the coming months.

By Dror Neer Kastel, Nadlan Center

Dun & Bradstreet, a global business information and analytics company, predicts a drop in home prices in Israel in the near future. According to the company’s Q1 2025 market review, “There are initial signs of a change in direction: land prices in government tenders are declining, and growing market sentiment suggests that competition among developers—along with new regulatory restrictions from the Bank of Israel—will curb rising prices and may even result in lower apartment prices in the coming months. For developers, this presents a serious cash flow challenge. For the public, it could mark the beginning of some financial relief.”

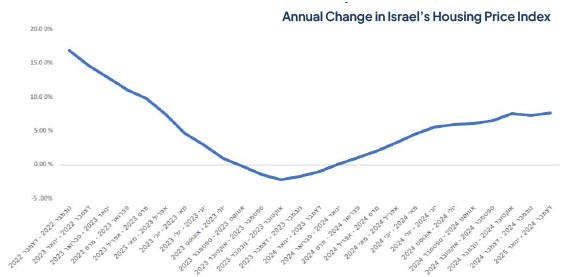

While the first quarter of 2025 showed a continued rise in home prices, creating further strain for buyers, the report also identifies growing credit shortages in the construction sector, delays in apartment handovers, and unprecedented regulatory steps from the Bank of Israel—all indicators that residential real estate prices could level off or decline later this year.

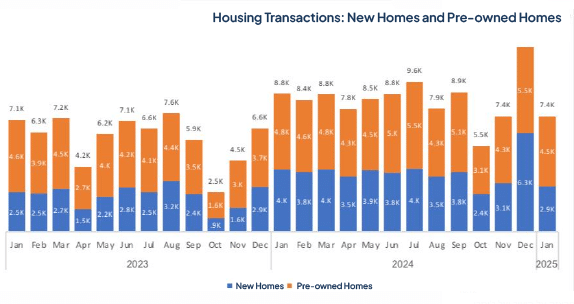

According to the review, Israel’s housing market began 2025 with a complex and uncertain outlook. On one hand, the end of 2024 saw a recovery in transaction volume—with a 65% increase in new home purchases and a 25.5% rise in second-hand apartment deals compared to 2023, based on data from the Central Bureau of Statistics. However, compared to 2022, this is only a partial recovery, with overall transaction volume down about 6%. The temporary market boost is mainly attributed to a December 2024 surge in deals, likely driven by VAT hike fears, which prompted early purchases.

The report highlights a growing concern among regulators: many developers marketed homes with deferred payment models, such as 20/80 and 90/10, based on balloon loans where the bulk of the payment is made only upon occupancy. This allowed buyers with limited capital—and sometimes no verified financial ability to sustain mortgage payments—to close deals. According to Bank of Israel data, balloon loans totaling NIS 3.2 billion were issued in December alone—four times the monthly average. In response, the Bank’s supervisory division imposed strict new rules that limit such financing, especially in projects where more than 25% of buyers defer most payments to the handover stage. These restrictions will significantly reduce developers’ ability to offer generous financing plans, likely causing a slowdown in transaction rates.

The construction phase is also facing difficulties: the industry continues to suffer from a serious labor shortage, particularly among small and mid-sized contractors. While 182,000 units were under construction in 2024, only about 53,000 were completed—a 12.3% decline from the previous year. Average construction time increased to 34.3 months, reflecting slower execution and logistical challenges on site. Some foreign workers brought in lack sufficient training, and full operational recovery on construction sites is proceeding slowly, hindered by logistical issues and rising wage costs.

As the market struggles to offer sufficient supply, home prices in Israel continue to rise. Comparing transactions from December 2024–January 2025 to the same period a year earlier, apartment prices increased by 7.7%. This price hike adds to household burdens: living costs remain high and average mortgage payments have nearly doubled over the past decade, while average wages have only risen by 32% in the same period. “The practical result is that buying an apartment in Israel is becoming increasingly difficult—even for dual-income households,” the report states.

Given this reality, more families are opting to delay purchasing and move into the rental market, which also shows consistent price increases. The average rent in Q4 2024 reached NIS 4,817, up 5% from the previous year. In Tel Aviv, the average rent for a three-room apartment was NIS 6,967, and NIS 8,584 for a four-room apartment—up about 4% from the previous year. Many cities recorded even sharper increases, contributing to higher consumer price indexes and inflationary pressures that complicate interest rate cuts by the Bank of Israel.

As previously stated, D&B expects that falling land prices in government tenders, growing competition among developers, and new Bank of Israel regulations will slow or reduce home prices in the coming months.

Ronny Alpern, VP of Data and Product at Dun & Bradstreet, explained that the construction industry is under intense financial and structural pressure. “Contractors are grappling with tight regulations, financing difficulties, and a severe labor shortage, all of which lead to handover delays and higher building costs. At the same time, buyers face high interest rates, costly mortgage repayments, and declining purchasing power—making homeownership an increasingly elusive dream. While market data show a 7.7% annual price increase, we believe that once the impact of the financing restrictions settles in and competition among developers intensifies, we will see price stagnation or even a decline later this year.”

Nadlan Center is Israel’s leading real estate news and knowledge platform in Hebrew, created for industry professionals. Founded by experts in the field, it delivers in-depth, up-to-date coverage on urban renewal, planning and construction, taxation, and housing policy — tailored to the needs of developers, investors, planners, and financiers. In addition to its widely read news content, Nadlan Center hosts major industry events, professional conferences, and training programs that support the growth and development of the Israeli real estate sector.

Learn more: https://www.nadlancenter.co.il